The year 2024 looms as a potential landmark for Mergers and Acquisitions (M&A) in the Biotech sector, influenced heavily by the changing dynamics of the financial markets and the evolving landscape of industry regulations. This period is poised to witness an increase in strategic consolidations, driven by the necessity of adaptation among companies facing the challenges of capital expenditure in a fluctuating economic environment. Against this backdrop, this article, crafted by Peter Homberg, delves into the multifaceted world of M&A in biotech. Homberg, renowned for his legal acumen, played a pivotal role in one of Germany’s most notable transactions in the cannabis space – the acquisition of Storz & Bickel by Canopy Growth. His involvement in this groundbreaking deal, particularly at a time when Germany is experiencing significant changes due to cannabis legalization, underscores the nuanced complexities of the sector. While the future for biotech may not be straightforward, the surge in activity, especially in Germany’s burgeoning market, heralds a year of substantial developments and opportunities in the industry.

The following article is translated from M&A REVIEW.

- Introduction

Few industries have undergone such development in recent years as the biotech industry. A major accelerator was also the Covid-19 pandemic, which brought activities around pharmaceuticals and medical devices into focus. Like the entire technology sector, however, biotech company valuations fell victim to risk reduction in the markets last year. Biotech companies are usually in the early stages and often have unproven products and uncertain revenue streams, making them more vulnerable to changes in macro and market conditions observed since the end of 2021 with persistent inflation, rising interest rates, and slowing economic growth. This became evident in the recent market downturn. Biotech stocks plummeted 87% in 2022 compared to 2021.¹ A normalization post-Covid-19 pandemic was expected for 2023. However, companies still have to contend with rising energy prices, very high inflation, and from an investor perspective, a tightening financial environment with rising interest rates and ongoing supply chain problems and other challenges.

- Preliminary Note

Discussions on the biotech industry partly include the pharmaceutical industry, as they are closely related areas that increasingly intertwine.² Biotechnology refers to the application of biological processes, organisms, or systems to develop products or technologies. This can involve using microorganisms, plant cells, animal cells, or molecular techniques to produce products such as drugs, vaccines, enzymes, or gene therapy.

The pharmaceutical industry is a specific sector that develops, manufactures, and distributes drugs or medicines. However, biotechnological methods and technologies are increasingly used in the pharmaceutical industry to develop new drugs. Biopharmaceuticals – drugs produced through genetic engineering – now account for about one-third of the German drug market.³

- Background

Like many industries, the biotech sector was expected to decline due to the Covid-19 pandemic. Instead, it led to an unprecedented boom. The total volume of M&A deals climbed to record levels in Germany in 2020 and 2021, with 2.03 and 2.06 billion EUR, respectively.⁴ Key focal points were the two mRNA vaccine manufacturers Moderna and BioNTech and Covid-19 diagnostics companies like Centogene⁵. Companies in gene medicine, in particular, are actively seeking capital from investors who want to benefit from advances in gene editing, mRNA therapy, and sRNA therapy. Many new companies are focusing on novel drug delivery technologies using adeno-associated virus vectors (as so-called shell-free viruses, they show strong resistance to external influences and can carry therapeutic payloads) to replace or alter genes at the molecular level, which may revolutionize the way diseases are treated.⁶

After two record years, the achieved financial volume plummeted due to rising interest rates and the onset of the Ukraine conflict. As a result, the industry in Germany experienced a massive downturn in the overall M&A volume to just around 270 million EUR. The most valuable M&A transaction of German biotech companies in 2022 was the acquisition of c-LEcta by the Kerry Group. The total value of 52.7 billion EUR in capital raisings in 2022 was still the second-highest value in the history of the biotechnology stock market and was significantly above the values before the pandemic. However, further IPOs were not recorded, and the total market capitalization of German biotech companies fell by 38%.⁷

Internationally, the volume of M&A transactions significantly declined in the pandemic-affected years 2020 and 2021. Internationally, the acquisition of Irish Horizon Therapeutics by the American company Amgen, with a volume of 27.8 billion USD, was especially significant. However, the total volume in 2022 would have been only 4.2 billion EUR without this transaction.⁸

- Current Developments At least two main trends in the biotech sector are currently observable, significantly influencing the development of M&A deals.

4.1 Expiring Drug Patents The imminent expiration of many blockbuster drug patents is causing uncertainty among investors and pharmaceutical companies. Consequently, the corresponding drugs can be produced and sold at a lower price by other companies following the patent expiration. Projected revenue losses necessitate the development and manufacturing of new drugs, which is risky and expensive⁹, as not every development phase ends with a successful drug.

More than 70% of the M&A deals announced since spring 2023 involve drugs for the prevention, diagnosis, and treatment of rare diseases (so-called “Orphan Drugs”).¹⁰ The USA exempts them in many cases from the planned Medicare price cuts and particularly promotes this area. The EU legislator has also created financial incentives for their development and marketing, such as granting an exclusive market right for ten years, as provided by Regulation (EC) No. 141/2000 on orphan medicinal products.¹¹ This makes them particularly attractive to large pharmaceutical companies.

Moreover, biopharmaceuticals and replacement preparations of biotechnological products (also known as biosimilars) are considered particularly promising for the future. Biosimilars are biological drugs developed to mimic existing biological medicines (known as reference products). They resemble the reference product in terms of quality, safety, and effectiveness.¹² Biosimilars have the potential to reduce healthcare costs as they can be offered as more affordable alternatives to the more expensive reference products after patent expiration. The product markets of Orphan Drugs and biosimilars offer interesting investment opportunities due to medical advancements in these areas.

4.2 Geographical Market Changes Another trend observed is the continued outsourcing of development and production. Clinical trials and subsequent development phases are becoming more complex and lengthy due to restrictive legislation and regulations. This also means that the supply and value chain becomes more complex and geographically inhomogeneous.¹³ Therefore, the focus of development and production is increasingly shifting away from industrialized countries to new markets in emerging countries. The recent drug shortages have led to a rethink in this regard. For example, the USA has granted subsidies to promote re-shoring.¹⁴ Restrictions for foreign buyers of local assets and a relaxation of regulatory requirements, such as for price caps, could also influence M&A activities.

The virtual simulation of new drug components and their effects will also gain importance in research and development of new drugs, as will personalized medicine. Also, due to this cost-intensive research, health costs in the aging societies of industrialized countries continue to rise.

Pharmaceutical companies use mergers and acquisitions as a tool to avoid the need to provide research and development budgets (R&D) in these areas.¹⁵ This can often prove to be a faster and more cost-effective way to enter a new market than developing the product or technology itself. The rising development cycles increased the average cost of developing a new drug by 298 million USD to 2.3 billion USD in 2022.

However, biotechnology is not without challenges. In particular, venture capital funds are more demanding today. Early-stage investments have declined sharply since 2021, and many startups that quickly raised a Series A round in better times may now have difficulty securing follow-on funding.¹⁶ This also has implications for future M&A activities. The incentive for this is also the assumption that there will be continuously higher regulatory challenges, which will drive development costs and times to previously unreached heights.

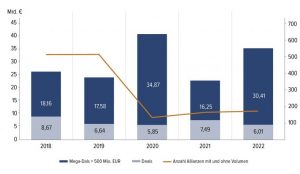

Transaction activity could be dominated by the formation of alliances, which the pharmaceutical industry, in particular, relies on. Such strategic alliances, involving cooperation between two or more legally and economically independent companies, are actually a safer way to avoid transaction risks, especially in times of crisis.

Fig. 2 • Deals Through Alliances in Europe 2018-2022

Source: E&Y, German Biotechnology Report 2023, p. 55

- Current and Future Challenges

Like all economic sectors, the transaction business in the biotech industry depends on many factors, as shown by the Covid-19 pandemic and the effects of (geo-)political conflicts. However, there are other influences on which the success of business transactions can depend.

5.1 Regulatory Uncertainty

The biotech industry is heavily dependent on regulatory decisions, creating uncertainty for mergers and acquisitions. In Europe, the European Medical Device Regulation (2017/745, “MDR”), which came into force on April 5, 2017, and became effective on May 26, 2021, recently posed financial and organizational challenges for companies.¹⁷ The MDR introduced, among other things, significant changes in terms of conformity requirements before marketing and risk management.

5.2 Pricing and Research Costs

As already shown, the reorganization of the pharmaceutical market after the expiration of drug patents will lead to a reorganization in the pricing of biopharmaceuticals. This will also have immediate effects on M&A transactions.

The development of new drugs and therapies is expensive, increasing the financial burden on companies. In 2022, R&D spending in the German biotech industry continued to rise. A total of 3.33 billion EUR was invested, 17.6% more than in 2021.¹⁸

- Outlook

The hype around the biotech sector from 2020/2021 is over. It is clear that measures need to be taken to provide the biotech industry with the appropriate framework for sustainable capital raising and development opportunities. This surely includes reducing regulatory and bureaucratic hurdles and improving financing to advance developments better and faster to market maturity.¹⁹ However, more commitment from investors is also required, particularly the mobilization of large institutional investors, which in turn can bring about large alliances, a strategy that has proven very successful in recent years.²⁰

Nevertheless, it should also be noted that the biotech industry has proven remarkably robust in recent years. Despite numerous challenges for M&A transactions in the life sciences sector due to uncertainty and planning insecurity, positive factors are evident that contribute to continued demand, such as the pressure to innovate and the demographic factor, which is becoming increasingly important. Government programs like the “Cancer Moonshot” initiative²¹ in the United States are expected to lead to further investments in high-growth biotech and pharmaceutical companies.

————-

1 E&Y, Biotechnologie-Report 2023, S. 56.

2 Vgl. www.handelsblatt.com/unternehmen/industrie/biotechnologie-die-kapitalsuche-fuer-biotech-unternehmen-bleibt-schwierig/29181020.html (Letzte Einsicht: 03.11.2023).

3 www.vfa.de/de/arzneimittel-forschung/medizinische-biotechnologie/biotech-deutschland/wachstum (Letzte Einsicht: 03.11.2023); nähere Ausführungen unter III. 1.

4 E&Y, Biotechnologie-Report 2023, S. 56.

5 www.goingpublic.de/life-sciences/centogene-startet-pilotprojekt-zur-diagnose-von-unentdeckten-covid-19-faellen/ (Letzte Einsicht: 03.11.2023).

6 Im März 2023 zahlte das deutsche Biowissenschaftsunternehmen Sartorius 2,6 Mrd. USDMrd. USD für Polyplus, ein französisches Unternehmen, das virale Vektoren für Zell- und Gentherapien entwickelt. Die Produkte des Unternehmens werden verwendet, um genetisches Material in Zellen einzubringen, das zur Behandlung von Krankheiten wie Krebs, Sichelzellenanämie und Hämophilie eingesetzt werden kann.

7 https://de.statista.com/infografik/30122/biotech-unternehmen-in-europa/ (Letzte Einsicht: 03.11.2023).

8 E&Y, Biotechnologie-Report 2023, S. 58.

9 www.aerzteblatt.de/nachrichten/126312/Was-die-Entwicklung-eines-neuen-Medikaments-kostet (Letzte Einsicht: 03.11.2023).

10 www.bfarm.de/DE/Kodiersysteme/Kooperationen-und-Projekte/Orphanet/Orphanet-International/Orphan-Drugs/_node.html (Letzte Einsicht: 03.11.2023)

11 BeckM&A-HdB, § 78 Transaktionen in der pharmazeutischen Industrie Rn. 2, beck-online, https://beck-online.beck.de/Dokument?vpath=bibdata%2Fkomm%2Fmeyersparenbergjhdbma_2%2Fcont%2Fmeyersparenbergjhdbma.glsect78.gli.htm&pos=9&hlwords=on.

12 https://biosimilarsverband.at/biosimilars/herstellung/ (Letzte Einsicht: 03.11.2023), www.biosimilars.de/herstellung-n-qualitat (Letzte Einsicht: 03.11.2023).

13 www.aerztezeitung.de/Wirtschaft/Emerging-Markets-Lockruf-der-Schwellenlaender-419220.html (Letzte Einsicht: 03.11.2023).

14 Bold Goals for U.S. Biotechnology and Biomanufacturing, 2023, S. 28 ff., www.whitehouse.gov/wp-content/uploads/2023/03/Bold-Goals-for-U.S.-Biotechnology-and-Biomanufacturing-Harnessing-Research-and-Development-To-Further-Societal-Goals-FINAL.pdf.

15 www.deraktionaer.de/artikel/pharma-biotech/im-uebernahmefieber-pharma-branche-schlaegt-2022-kraeftig-zu-20312010.html (Letzte Einsicht: 03.11.2023).

16 www.handelsblatt.com/unternehmen/industrie/venture-capital-biotech-firmen-muessen-sich-auf-durststrecke-bei-der-finanzierung-einstellen/29041780.html (Letzte Einsicht: 03.11.2023).

17 www.wiwo.de/my/erfolg/gruender/eu-medizinprodukte-verordnung-diagnose-gefaehrlich-viel-buerokratie/27377158.html (Letzte Einsicht: 03.11.2023).

18 https://biotechnologie.de/statistics_articles/37-daten-fakten-zur-biotech-branche-im-ueberblick#:~:text=Die%20F%26E%2DAufwendungen%20der%20%E2%80%9Eroten,%E2%82%AC (Letzte Einsicht: 03.11.2023).

19 BT-Drucksache 20/2376, S. 7, https://www.bundestag.de/resource/blob/935780/4a42195e360496d0db1ed90f56df9514/Stellungnahme_BIO-Deutschland-e-V–data.pdf.

20 E&Y, Deutscher Biotechnologie-Report 2023, S. 50.

21 https://www.cancer.gov/research/key-initiatives/moonshot-cancer-initiative (Letzte Einsicht: 03.11.2023).