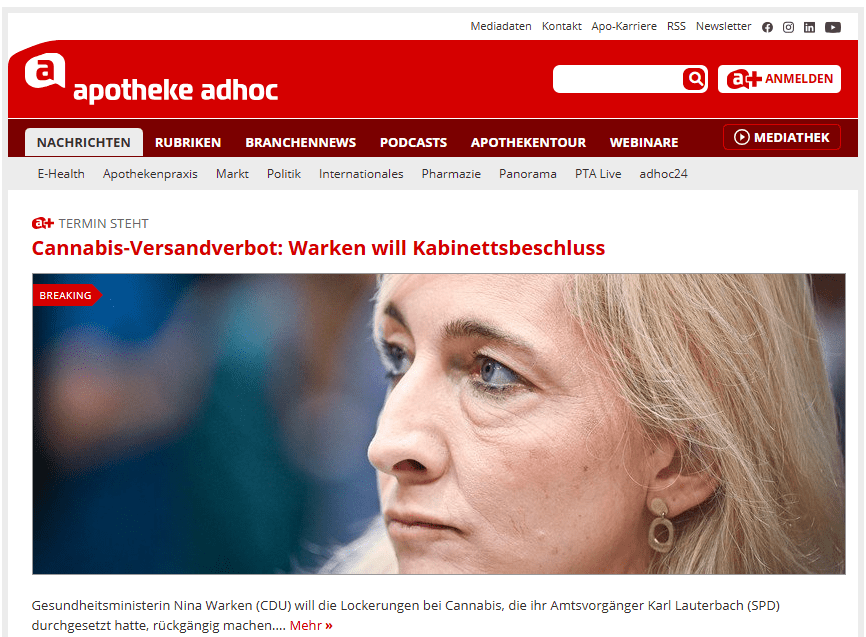

Germany’s medical cannabis landscape is facing a dramatic regulatory shift as Health Minister Nina Warken (CDU) moves to reverse the liberal policies implemented by her predecessor Karl Lauterbach (SPD). The proposed restrictions come at a time when Germany has established itself as the world’s largest medical cannabis market, creating a striking contradiction between policy tightening and explosive market growth.

The Warken Restrictions: A Return to Traditional Medical Practice

Warken’s proposed legislation, scheduled for cabinet approval on October 8th, represents a comprehensive rollback of telemedicine-friendly cannabis policies. The key restrictions include:

End of Telemedicine Prescriptions: Cannabis flower prescriptions will require in-person consultations, with video consultations banned for initial prescriptions. Even follow-up prescriptions will require at least one in-person visit every four quarters (16 months).

Mail-Order Ban: The legislation will criminalize the direct shipping of medical cannabis to patients, forcing all transactions through physical pharmacies with mandatory in-person consultations.

Enhanced Due Diligence: Doctors will face increased obligations for comprehensive medical histories, physical examinations, and patient education about addiction risks and side effects.

The rationale centers on patient safety concerns. According to the draft legislation, “due to addiction risk and other health risks, side effects and adverse drug reactions, personal medical contact with the person to be treated is sensible and required.” The ministry argues that cannabis flowers, lacking specific approval for particular conditions, require elevated care standards that cannot be met through digital consultations alone.

Market Reality: Germany’s Cannabis Boom Continues

These restrictions are being implemented against the backdrop of unprecedented growth in Germany’s medical cannabis market. Since the landmark CanG reform in April 2024, Germany has experienced explosive expansion:

Import Surge: Cannabis imports have increased fivefold, rising from just over 8 tonnes in Q1 2024 to 43.3 tonnes in Q2 2025. The first half of 2025 alone saw over 80 tonnes imported, with trailing twelve-month imports reaching 132 tonnes.

Market Dominance: Germany has emerged as the undisputed leader of the global medical cannabis market, with projections suggesting imports could exceed 160 tonnes this year and potentially surpass 200 tonnes in coming years.

Patient Growth: The patient population has expanded by nearly 300% in the past year, driven largely by telemedicine accessibility that Warken now seeks to restrict.

Supply Chain Challenges and Political Tensions

The timing of Warken’s restrictions coincides with existing supply chain pressures. Germany’s medical cannabis supply relies heavily on the Canada-Portugal-Germany triangle, but compliance issues in Portugal have created bottlenecks. Portuguese processors face increased regulatory oversight following criminal investigations and license suspensions, causing significant workflow delays.

Additionally, Germany has reportedly reached its International Narcotics Control Board (INCB) quota for 2025, with current annual demand estimates of 122 tonnes already exhausted. This has temporarily suspended new import permits, creating administrative delays that compound the regulatory uncertainty.

Industry and Patient Pushback

The proposed restrictions face significant opposition from multiple stakeholders:

Patient Concerns: A survey by MedCanOneStop found that 92.6% of patients fear recriminalization, with 59.2% indicating they would switch to illicit sources if digital access were blocked.

Industry Opposition: Telemedicine platforms and mail-order services have mobilized against the plans, warning of a “collapse in patient care.” Companies like Grünhorn, which serve rural areas with limited pharmacy coverage, argue that the restrictions will create geographic barriers to treatment.

Political Division: The SPD and most industry players oppose the rollback, while the CDU pushes for stricter controls. The fragile coalition dynamics may limit the extent of enforceable restrictions.

The Pharmacy Challenge

Germany’s physical pharmacy infrastructure reveals the practical challenges of Warken’s approach. Several federal states lack even a single cannabis-specialist pharmacy, making the proposed in-person requirement particularly burdensome for rural patients. Mail-order services have been essential for equitable access, especially in underserved regions.

The German Pharmacists’ Association (ABDA) supports the reforms, advocating for tighter price regulation and exclusion from standard reimbursement pathways. However, this position contrasts with patient advocacy groups who emphasize accessibility over regulatory control.

Economic Implications

The regulatory uncertainty is already reshaping business models and investment patterns. The recent €27 million acquisition of 51% of Remexian—Germany’s fastest-growing cannabis distributor—by Canadian company High Tide reflects the market’s strategic response to supply chain volatility and regulatory risk.

Despite serving budget-conscious patients, companies are diversifying their sourcing strategies to reduce dependence on Portuguese processing facilities and maintain delivery reliability. The focus on supply chain redundancy reflects the structurally fragile nature of international medical cannabis trade under narcotic regulations.

A Market in Contradiction

Germany finds itself in a paradoxical position: simultaneously the world’s largest medical cannabis market and the site of Europe’s most significant regulatory rollback. Imports are paused due to quota limits while demand soars. Compliance requirements escalate while product innovation accelerates. Political resistance hardens while commercial expansion continues.

This contradictory moment may prove defining for European medical cannabis policy. As Warken stated, “My position is well known: there is a need for action.” However, the question remains whether restrictive action can effectively govern a market that has already demonstrated explosive organic growth.

The October 8th cabinet meeting will mark a critical juncture, determining whether Germany’s medical cannabis sector faces a temporary recalibration or a fundamental shift toward restrictive governance. The outcome will likely influence not only German patients and industry players but the broader European approach to medical cannabis regulation.

For now, Germany remains caught between its role as the gravitational center of global cannabis trade and the conservative logic of traditional medical regulation—a tension that the Warken restrictions seem unlikely to resolve definitively.